One Step Closer to Victory in Energy War with the Kremlin: What EU Countries Agreed On

On September 9, the energy ministers of the EU countries called on the European Commission to introduce a price cap on the gas against the backdrop of rapidly growing energy supply costs borne by consumers and enterprises. There is a consensus that a gas price cap is necessary, but the European Commission and EU countries need some time to work out and agree on a concrete solution.

The Kremlin’s ultimatum with a threat to completely cut off gas supplies to the EU, if the sanctions are not lifted, essentially moved the confrontation into a new "acute" phase. What does the European Union already have in its arsenal for an energy war with Putin?

Average Russian fossil fuel prices have more than doubled since 2021. According to a new analytical report by CREA, in the first six months of the war (from February 24 to August 24), Russia received 158 billion euros in revenue from fossil fuel exports.

The EU imported 54% of this volume, worth approximately €85 billion.

Russia exploited not only Europe’s dependence on Russian gas, but also manipulated the mechanisms of price formation in the gas and electricity markets while receiving huge revenues.

Over the past six months, Gazprom made as much money from gas sales in the EU now as it did in the first half of 2021 while delivering less than a third of last year’s volumes.

The prices the EU pays for Russian gas are currently linked to prices on Europe’s internal gas market, which has more than tripled compared to last year. This means that even after gas imports from Russia fell by 70%, Russia’s export revenues remained almost unchanged. Therefore, breaking the link between European market prices and prices paid to Russia is of paramount importance, both to reduce Russian export revenues and to protect vulnerable consumers.

In the spring, the EU’s tactic was to stock up gas in storage in advance to prepare for winter, which was successfully done – by the beginning of September, European gas storage had accumulated more gas than in the same period of 2021.

Without introducing the hard-hitting energy sanctions in April-May, the European Union continued to buy Russian gas but was already preparing for the scenario of a complete shutdown of supplies in winter.

Despite the Kremlin’s bravado that "without Russian gas, Europe will freeze" and its belief in the invincibility of their gas pipelines, the reality is that with the full arsenal of energy sanctions in place, the Putin regime will be out of cash in a matter of weeks.

In fact, Russia’s economy, and especially its energy sector, is more vulnerable to a full-scale "energy" war than the EU economy.

The full coal embargo has already led to a reduction in coal production in Russia, put tens of thousands of miners out of work, and ignited a process of socio-economic destabilization in Kemerovo, the largest coal region. And this is only the beginning because coal is only 10% of the exports of Russian fossil fuels.

In financial terms, the export of oil and oil products is the largest and key source of income for Putin’s regime. And now that Europe has covered its rear by stockpiling gas and adopting a plan to reduce its consumption, this key source is now fully in the line of sanctions firing.

Source: Center for research on energy and clean air (CREA)

Last week, G7 governments agreed on a plan to implement this price cap on global markets. It provides for the establishment of a ban on insurance, financial, intermediary, and other services for Russian oil cargoes, the value of which exceeds the price limits for crude oil and oil products.

The levels of restrictions have not yet been established, but this powerful remedial mechanism has already been agreed upon in principle.

According to unofficial estimates, the global price range for Russian oil can be set at around $60 per barrel.

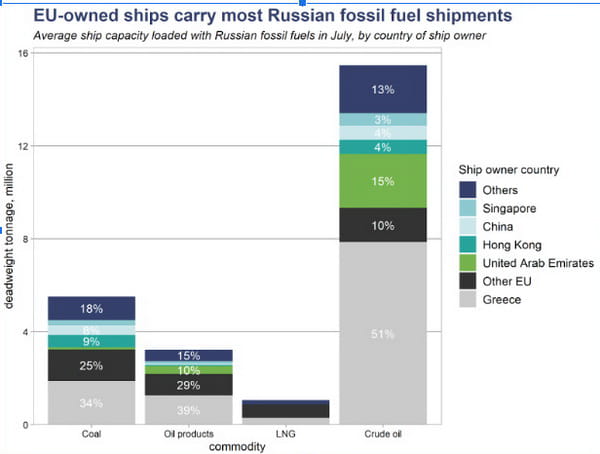

Of all vessels carrying Russian fossil fuels worldwide in July, 62% were owned by EU-registered shipping companies and 73% were insured in the UK and Norway, according to CREA’s analysis. Because of its dominant role in maritime logistics, Europe has all the leverages to impose a price cap on Russian oil exports, which could effectively cut off the flow of petrodollars to the Kremlin. This is what they fear the most.

Therefore, our key allies, the G7 and the EU must now limit the Kremlin’s financial income from the export of Russian oil to world markets. This is a key battle on the sanctions front against warmongering Russia, so we must demand decisiveness, consistency, and coherence from the EU.

In implementing oil sanctions, the G7 and the EU must create strong enforcement mechanisms and regulations to prevent the free flow of Russian oil to other potential buyers, before UK and EU embargoes enter into force. It is necessary to eliminate all loopholes.

This is urgently needed. Vessels belonging to European companies have provided increased supplies of Russian oil to India, the Middle East, and Egypt in recent months. It is also necessary to prevent marketing through indirect routes, in particular, to control and identify the Russian origin of processed petroleum products and mixed oil.

In particular, a mixture of Kazakh and Russian oil is still being exported to the UK, and if the rules on mixed oil are not tightened as part of the upcoming UK embargo, these imports could continue until 2023. Other loopholes, such as the transshipment of Russian oil through EU ports, as happened in Estonia, must also be eliminated.

Along with "main caliber" hard-hitting energy sanctions, for a decisive and final victory over Russia in the energy war, it is important for Europe to accelerate the transition to renewable energy sources as much as possible, insulate buildings and electrify heating and transport.

The introduction of heat pumps, electric cars, and other clean technologies is what will guarantee energy independence from dictatorial regimes, that are propped up by fossil fuel exports and allow us to keep cool in a world that is rapidly heating up due to the climate crisis.

Separately, Gazprom needs to be charged for the damage to the environment.

The gas that is not sold to Europe, is simply being flared, producing huge emissions of methane into the atmosphere due to incomplete combustion, exacerbating the climate crisis.

From Gazprom, for each cubic meter of methane that ended up in the atmosphere and is not used by the EU consumers, it is necessary to demand compensation to the UN Green Climate Fund in court.

Written by Svitlana Romanko

Founder of Razom We Stand

Publications in the "Expert opinion" section are not editorial articles and reflect exclusively the author's point of view.